Past Boundaries: Browsing the Formation of Offshore Companies effortlessly

Wiki Article

Tailored Offshore Business Management Solutions

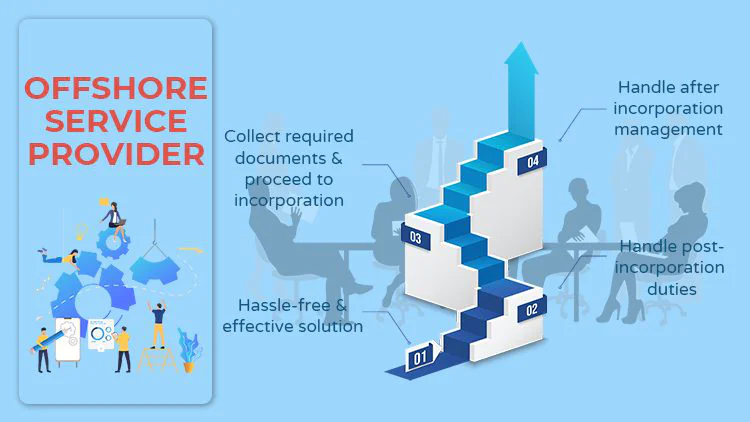

Tailored offshore business monitoring solutions use a strategic approach to navigating the intricate world of international service. In this conversation, we will certainly discover how tailored remedies can assist businesses achieve their objectives, while additionally analyzing the advantages of leveraging overseas company administration solutions.Advantages of Offshore Business Monitoring

Offshore jurisdictions often provide positive tax obligation regimens, permitting companies to decrease their tax liabilities legitimately. By developing an offshore entity, organizations can take advantage of lower or absolutely no company tax prices, as well as exceptions on funding gains, dividends, and inheritance tax obligations.Another benefit of overseas company management is boosted personal privacy and confidentiality. This degree of privacy can be appealing to people who want to maintain their business activities personal.

Offshore company monitoring also uses boosted property defense. Offshore territories typically have strong possession protection regulations, making it hard for outside parties to seize or access these assets.

Last but not least, overseas firm monitoring can assist in worldwide organization procedures. Developing an overseas entity can supply services with a regional existence in a foreign market, allowing them to expand their global reach. This can lead to new business possibilities, accessibility to international funding, and the capacity to deal with a more comprehensive client base.

Tailored Solutions for Business Development

Tailored services for business development encompass customized approaches and strategies that cater to the one-of-a-kind requirements and goals of companies seeking to grow their procedures. As businesses evolve and adapt to the ever-changing market characteristics, it ends up being vital for them to establish customized remedies that address their details requirements. These options consider aspects such as market conditions, sector trends, affordable landscape, and internal capabilities.Among the key elements of customized options for business growth is market study. Business need to extensively evaluate the target audience to recognize growth chances, recognize customer preferences, and examine the competitive landscape. This research aids in creating methods that align with the marketplace dynamics and make sure an affordable advantage.

An additional important component of tailored services is critical preparation. Companies need to specify clear purposes and goals for their expansion plans. This includes determining prospective markets, creating access methods, and laying out the necessary resources and financial investments needed for successful growth.

Moreover, tailored remedies for company expansion may involve collaborations and cooperations with various other companies. This can aid firms take advantage of the competence and resources of critical partners to increase their development plans.

Making The Most Of Tax Obligation Optimization Opportunities

Making the most of tax optimization opportunities requires a detailed understanding of tax legislations and guidelines, along with strategic preparation to lessen tax obligations while staying certified with legal needs. Offshore company administration services offer businesses the chance to optimize their tax planning approaches by capitalizing on jurisdictions with favorable tax obligation regimes. By developing an offshore business, services can gain from different tax motivations, such as reduced corporate tax obligation prices, tax exemptions on certain kinds of income, and the capability to defer or decrease taxes on earnings earned abroad.One key aspect of optimizing tax optimization chances is to carefully assess the tax regulations and policies of different territories to determine the most helpful choices for the company. This calls for a thorough understanding of the tax obligation landscape and the capacity to navigate complex worldwide tax frameworks. Additionally, tactical preparation is vital to make sure that business structure is fully compliant with lawful demands and avoids any type of possible dangers or penalties associated with tax evasion or hostile tax obligation avoidance systems.

One more crucial consideration in tax obligation optimization is making use of tax treaties and contracts between nations. These arrangements can assist services avoid double taxes and provide systems for dealing with tax obligation conflicts. By leveraging these treaties, businesses can additionally optimize their tax approaches and minimize tax obligations.

Ensuring Property Defense and Discretion

To guarantee miraculous protection of possessions and preserve rigorous discretion, organizations must apply durable approaches and protocols. Protecting possessions from potential risks and hazards is important in today's affordable organization landscape. Offshore firm monitoring options provide a series of steps to ensure property security and confidentiality.One key approach is the splitting up of individual and service properties. By establishing an overseas business, company owner can separate their individual assets from those of business. This separation provides a layer of protection, ensuring that personal possessions are not in danger in case of lawful issues or monetary troubles dealt with by the company.

Offshore jurisdictions typically supply positive lawful frameworks that supply improved possession protection. By utilizing these frameworks, businesses can secure their possessions from legal disputes or potential lenders.

Confidentiality is just as vital in maintaining the personal privacy and security of organization possessions. Offshore territories usually have rigorous privacy regulations that protect the identities of useful proprietors and investors. These regulations guarantee that delicate information continues to be confidential and inaccessible to unauthorized people or entities.

Along with lawful frameworks and confidentiality legislations, services can further enhance property protection via making use of nominee solutions. Nominee supervisors and investors can be selected to act upon behalf of the business, adding an added layer of privacy and privacy.

Leveraging Offshore Company Monitoring Services

Offshore business management services offer organizations a tactical advantage in optimizing procedures and achieving global growth. These services give organizations with the experience and sources needed to navigate the complexities of global markets and policies. By leveraging overseas company administration services, organizations can take advantage of a series of benefits.One of the vital advantages is the capacity to access brand-new markets and tap right into an international customer base. Offshore company monitoring solutions can help businesses develop a visibility in foreign markets, enabling them to broaden their reach and raise their customer base.

Additionally, overseas business monitoring services can supply businesses with cost-saving check my reference chances. By developing operations in overseas territories with positive tax obligation regimes, services can lower their tax obligation liabilities and boost their earnings. Moreover, these solutions can click here to read help services in attaining functional efficiency with streamlined procedures and accessibility to specialized resources.

Another advantage of leveraging offshore company monitoring solutions is the boosted asset defense and discretion they use - formation of offshore companies. Offshore territories commonly have robust lawful structures that secure possessions from lawful disagreements, financial institutions, and other threats. This can supply services with peace of mind and guarantee the long-lasting safety of their possessions

Verdict

Finally, overseas company monitoring remedies provide various advantages such as service development, tax obligation optimization, possession defense, and confidentiality. By leveraging these solutions, companies can tailor their operations to meet their certain needs and maximize their success in the worldwide market. With a focus on efficiency and competence, offshore business management offers a critical benefit for companies looking for to expand their operations worldwide.In this discussion, we will certainly explore exactly how tailored remedies can aid services attain their goals, while also taking a look at the benefits of leveraging overseas business management solutions. Offshore company monitoring options use services the chance to optimize their tax obligation preparation approaches by taking advantage of jurisdictions with desirable tax programs. By developing an overseas firm, services can profit from various tax obligation incentives, such as lower corporate tax rates, tax exemptions on certain types of revenue, and the capacity to defer or minimize taxes on profits made abroad.

Report this wiki page